-

The IRS routinely lets right-wing churches break tax law & endorse political candidates

The wall that separated church and state is crumbling at a time when Christian nationalism is on the rise in the GOP.

-

Anti-LGBTQ hate group reorganizes as a “church” to avoid government oversight

Is it truly a part of the First Amendment’s “free exercise of religion” clause to exempt political lobbying groups from paying their fair share of taxes?

-

Your tax dollars are at work — helping hate groups act as “charities” that save millions

Lax enforcement of IRS policies allow anti-LGBTQ hate groups and white nationalists to masquerade as tax-exempt charities, saving them millions in taxes.

-

IRS recognizes a lesbian witches ‘church.’ But is it a sneaky attack on trans rights?

The “Pussy Church of Modern Witchcraft” now has the “religious freedom” to challenge trans rights in court.

-

Your tax dollars are building the religious right’s empire

Focus on the Family and Liberty University are both both taking money out of your pocket to line their pockets.

-

Focus on the Family declares itself a church so it no longer has to show the IRS its money trail

And they aren’t the only far-right, anti-LGBT group to go the way of a “church” to get out of filing documents with the IRS.

-

Chick-fil-A is still supporting our enemies’ causes

CEO Dan Cathy’s pledge to steer clear of social issues and focus on chicken turns out to be as solid as the brand’s waffle fries.

-

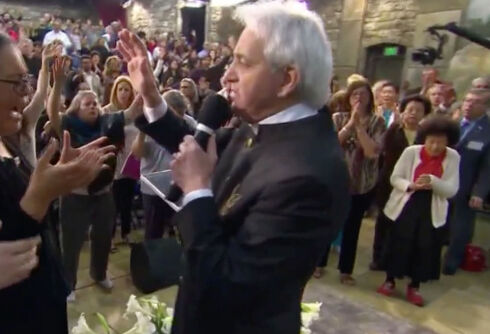

Televangelist Benny Hinn raided by the feds for fraud & tax evasion

Apparently he’s been “laying hands” on millions of his followers’ dollars.

-

Rachel Maddow got her hands on a Trump tax return and showed it on TV

The out MSNBC host said what was in the tax return she obtained wasn’t as important as the fact that they are obtainable.

-

Idaho tax bill advances despite gay marriage objections by Republicans

The lawmakers said Idaho should not conform with the Internal Revenue Service because the state’s constitution still includes language banning same-sex marriage.