Every day until the year 2030, over 10,000 Baby Boomers will be hitting retirement age, a staggering number that includes millions of LGBTQ+ Americans.

And many are unprepared to pay for it.

The oldest Boomers, among 73 million Americans born between 1946 and 1964, turn 77 this year, and they’re already spending tens of thousands of dollars a year on specialized and long-term care. Prices are only projected to go up.

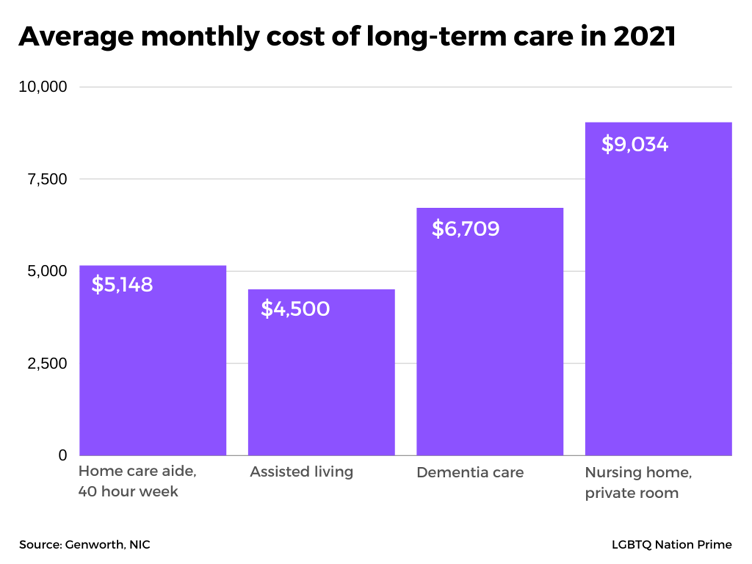

In 2021, the cost of a private room in a nursing facility averaged close to $110,000 a year, and according to the U.S. Department of Health and Human Services seven out of ten people will require long-term care in their lifetime.

Never Miss a Beat

Subscribe to our newsletter to stay ahead of the latest LGBTQ+ political news and insights.

What are the prospects for the 7%+ of LGBTQ+ Americans looking ahead to retirement? We take a look, by the numbers.

Long-term care for the estimated 70% of Americans who will need it comes in many forms, including aging in place with family or a full-time healthcare aide at home; assisted living in a retirement community; dementia care facilities designed for seniors with memory loss (sometimes in the form of “neighborhoods” in larger retirement communities); and shared or private rooms in nursing care facilities.

If you’ve got a healthy Social Security payment (the maximum benefit in 2023 is $3,627 a month for individuals retiring at 67), a substantial amount of savings and/or investment income, and a long-term care insurance benefit, you should be in good shape meeting your long term healthcare needs.

But, according to a 2022 survey by the Arctos Foundation and HCG Secure, only ten percent of retirees have a long-term care insurance benefit, and the average Social Security payment in 2023 is projected to be $1,688, well short of the maximum. In addition, savings and investments among the LGBTQ+ population are lower than those among U.S. households overall ($25,700, according to the Federal Reserve’s Survey of Consumer Finances). That means LGBTQ+ Boomers are at a disadvantage compared to their straight peers when it comes to covering the costs of long-term care.

But even the larger population has a clear lack of confidence they’ll be able to meet the costs of long-term care, according to a new poll on Healthy Aging from the University of Michigan, from paying for help at home while aging in place, to devoting all of their resources to a full service nursing home facility.

Another burden for LGBTQ+ Americans entering retirement is debt. In 2023, the vast majority of LGBTQ+ people (82%) had some form of personal debt, according to the LGBTQI+ Economic and Financial (LEAF) Survey. Nearly half had more than $10,000 in personal debt, including 20% who owed $50,000 or more. The largest sources, student loans and credit cards, differed from straight peers, who reported credit cards (29%) and mortgages (23%) as their largest sources. That reflects data indicating fewer LGBTQ+ respondents own their home — 43% compared to 65% of U.S. households overall in 2019 — another financial disparity faced by the broader LGBTQ+ population.

Regardless of how well-prepared you think you are for retirement and the financial risks associated with aging, circumstances can change in an instant.

According to the National Council on Aging, the likelihood of experiencing a financial shock is high as people grow older. Over a nine-year period, more than two-thirds of adults aged 70+ will experience at least one negative shock with financial consequences, such as falling into poor health, the death of a partner, or losing the ability to work or live independently.

The risk of paying substantial long-term care costs is even more pronounced. Among those aged 65 and over, half will have a significant need for help with two or more functional limitations or with dementia-related issues, and nearly one in six will need care for more than five years, incurring an average of more than $260,000 in lifetime expenses. Long-term care represents the single largest financial risk faced by older adults.

For people with few resources entering retirement, Medicaid can meet basic medical and long-term care needs but with strict income and asset requirements. The cap on an individual’s monthly income is $2,382 for eligibility, with a limit on assets of just $2,000, while a couple can earn up to $4,764 a month with combined assets of $3,000. An individual’s primary residence is often free from the asset test and, in some states, 401(k)/IRA assets are also exempt.

For people with too little money to meet their care needs on their own, but too much to qualify for Medicaid, it can mean being forced to “spend down” what assets they have to attain eligibility. Data from the Center for Retirement Research at Boston College indicates Medicaid has a statistically significant impact on meeting healthcare needs.

In the end, whether you come to retirement with too few assets to last a lifetime, or none at all, research shows Medicaid can help cut the percentage of those falling short almost in half.

In one of the richest countries in the world — still, inexplicably, without universal healthcare and facing a shortfall tsunami — at least it’s a start.

Don't forget to share: